2025 Global Fitness Industry Report Shows Record Growth and What’s Next for the Market

The global fitness industry, which was once regarded simply as a hobby or discretionary spending, in 2024 continued to expand its role as an essential part of public health and the economy around the world.

Reaching historic highs, memberships climbed 6% year-over-year, revenue increased an average of 8%, and the number of fitness facilities expanded nearly 4%, according to the 2025 HFA Global Report.

These gains confirm what operators and investors have long anticipated: fitness is a core part of modern health, wellness, and lifestyle spending.

But the bigger story is what’s ahead: According to the report, 91% of operators expect further revenue gains in 2025.

For investors and operators alike, this optimism signals both resilience and opportunity.

The 2025 HFA Global Report provides the most comprehensive overview available of the commercial fitness industry across nearly 30 countries and five major world regions, and is the most trusted annual resource for operators, suppliers, investors, policymakers, and advocates seeking to understand global industry dynamics.

Fitness Industry Shows Year-Over-Year Growth and Expansion

Since the COVID-19 pandemic, the health club and studio sectors have shifted from recovery to sustained expansion. Every key performance measure, from revenue and membership to penetration rate and facility openings, is showing consistent year-over-year growth.

“More people than ever are viewing fitness as essential, not optional. This year’s report highlights not just where the industry is going, but also how operators, advocates, and consumers are shaping that future together.”

Liz Clark, HFA President and CEO

For example, the confidence operators expressed last year (that membership would grow by more than 5%) proved accurate, as global memberships rose by 6% in 2024.

Additionally, global revenue rose an average of 8%, outpacing inflation in most regions, and facility counts increased nearly 4%.

You can learn more about growth numbers from 2023 in last year’s report, which shows how the industry has continued to expand year-over-year.

Confidence among operators is equally strong. In addition to the 91% of business leaders who expect revenue to increase again in 2025, 83% also predict profitability gains. Plus, 51.3% foresee member growth exceeding 5%, with an additional 35.4% anticipating more modest gains of 1–5%.

And this optimism cuts across models. From budget gyms and 24-hour clubs to boutique studios and premium operators, the entire market is expanding.

The 2025 HFA Global Report shows operators from across APAC, Europe, Latin America, and North America expecting gains across all key business indicators, including revenue, membership, and profit- ability in 2025.

Regional Fitness Industry Trends

The 2025 HFA Global Report features countries across Asia-Pacific, Europe, Latin America, the Middle East, and North America.

Country Snapshots

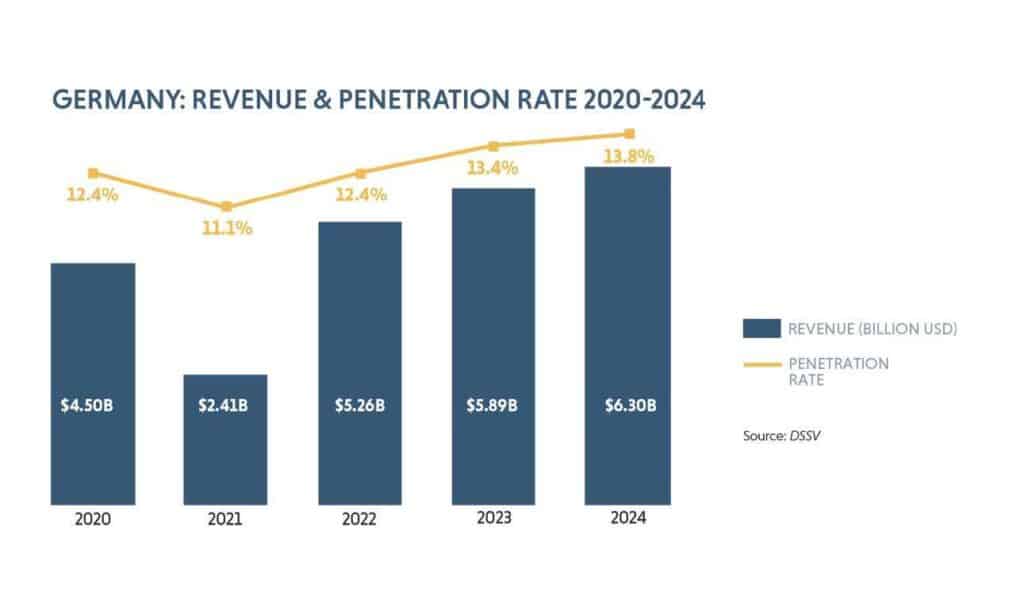

In the report’s country-by-country analysis, you’ll find a market snapshot that tells the story of each country, along with a narrative contribution from fitness federations or other industry leaders that offer a personalized look into the state of the industry in that country.

Sample of a graph from a market snapshot for a country in the 2025 HFA Global Report

The data (where possible) includes:

- Number of fitness facilities

- Estimated number of members or consumers

- Industry revenue

- Penetration rate among the population

- Macroeconomic and political context

- Market segmentation and consumer trends

- Industry outlooks

The narrative contributions, where relevant, include discussions about the evolution and success of government policies around the world that support the industry.

2024 Fitness Industry Policy & Advocacy Highlights

Countries such as Australia, Brazil, and the US are recognizing fitness as a critical contributor to public health through tax reforms and healthcare integration. These policy shifts help reduce barriers and increase support for fitness operators. The evolving regulatory environment signals growing government backing for industry growth.

Global Rankings Showing the Biggest Industry Players

Readers will also find many of the most recognized and fastest-growing commercial fitness operators in the world in the report’s global ranking, which lists the world’s leading fitness brands by 2024 revenue, number of units, and total members.

This ranking lets you know who the major players are in every market around the world and offers insight into market dynamics and investment potential – an invaluable resource for anyone invested financially in the global health and fitness industry.

Why This Report Matters

The 2025 HFA Global Report is the most comprehensive resource available on the commercial fitness market, covering nearly 30 countries and five world regions. It combines proprietary HFA research, independent audits, and federation partnerships to deliver unparalleled insight into the industry’s size, growth trajectory, and future outlook.

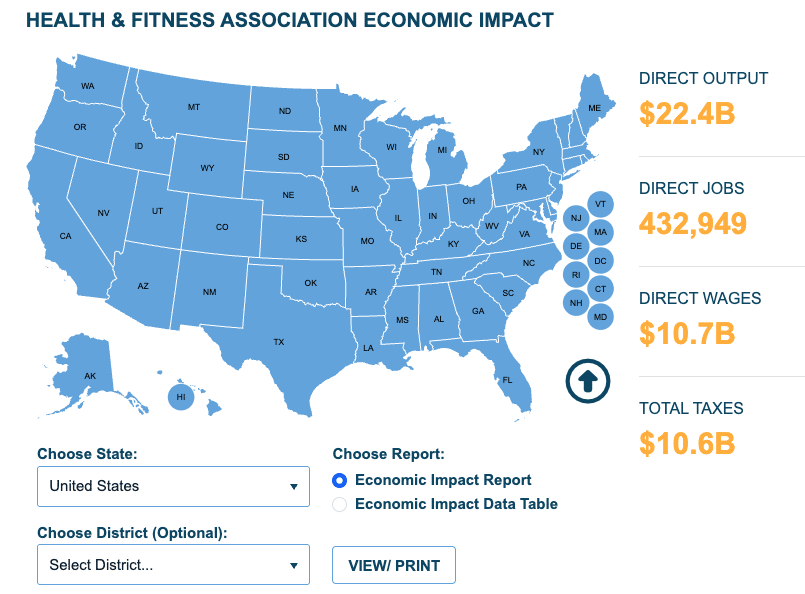

For operators, the report provides tools to plan expansion, optimize offerings, and understand emerging consumer behaviors. For investors, it offers data-driven intelligence to evaluate risks, identify opportunities, and align capital with growth markets. And for policymakers, it demonstrates how fitness is not just improving population health but also driving economic development worldwide.

The bottom line: the global fitness industry is growing, and it’s evolving into a cornerstone of health, wellness, and economic activity. The 2025 Global Fitness Industry Report shows where that momentum is strongest and where the next opportunities lie.

Ways to Use the Report

Wondering what this report means for you, or how it’s relevant to decisions you make in your day-to-day operations? Here are a few ways to use the report, whether you’re an investor, fitness business operator, or policymaker.

- Assess Market Size & Growth: Review global and regional facility counts, membership numbers, and revenue trends to identify high-growth markets.

- Evaluate Operator Confidence: Consider the survey data on operator revenue and profitability expectations for insights on sector stability and momentum.

- Spot Leading Players: Use brand rankings to identify dominant operators and potential acquisition targets.

- Understand Market Segmentation: Analyze consumer trends and segmentation data to tailor investment strategies to evolving demands.

- Monitor Policy & Regulation: Track policy shifts and government support in key markets that could impact industry growth or operational risks.

- Leverage Proprietary Research: Incorporate insights on pricing sensitivity and consumer behavior to anticipate market responses.

How the Data Was Collected

This report offers deeper insights than ever before, with record levels of participation in the data collection process. The information it contains is based on data collected from a combination of sources:

- Proprietary research conducted by HFA

- Independent audits and third-party research partners

- National fitness federations and trade groups

- Existing publications and studies from prior years

The 2025 Global Club & Studio Survey was conducted between February 2025 and June 2025. A link to the online survey was sent via email to fitness facility and studio operators, and promoted on the association’s digital platforms. The HFA, with support from federation partners, followed up with direct outreach by email. In total, more than 200 companies submitted data in time for inclusion in this report.

Survey responses were reviewed, cleaned, and processed for analysis. Revenue reported in local currencies was converted to US dollars using the average exchange rate for 2024. Data submitted through the survey informed the operator profiles section, leading company rankings, and business expectations included in the report.

For more information, contact HFA’s Vice President of Research, Anton Severin, at aseverin@healthandfitness.org