2025 Fitness Industry Foot Traffic Trends: Budget Gyms Booming, Engagement Up Across All Segments

The first half of 2025 showed that more Americans than ever are making fitness a regular part of their lives, as visitation numbers continue to grow year-over-year (YoY).

Compared to the same period last year, the number of visits to US commercial gyms, studios, and other fitness facilities rose 3.5%, and monthly visits per user increased 1.4% YoY, according to the Health & Fitness Association’s Fitness Industry Traffic (FIT) Tracker.

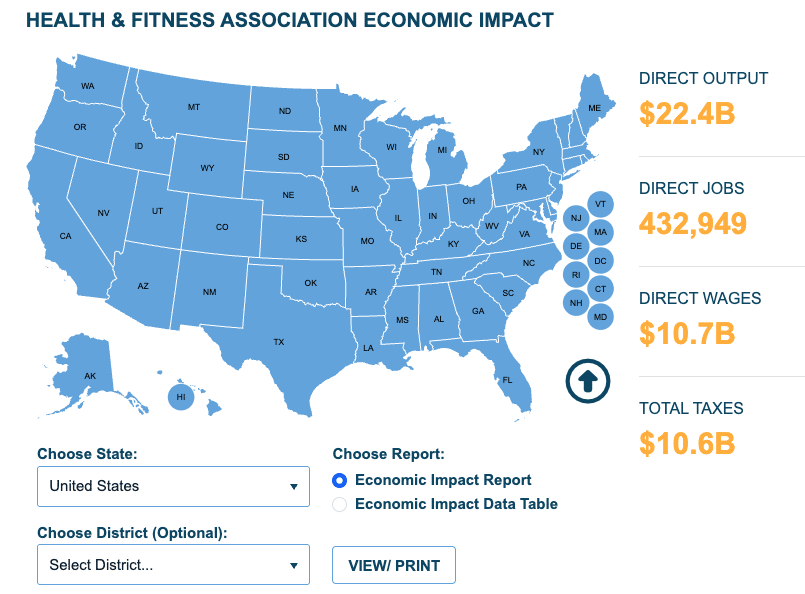

This latest data confirms that the US fitness industry is building on the strong momentum of recent years. In 2024, the industry reached record highs with 77 million Americans holding fitness facility memberships and nearly 19 million more engaging as non-member users, according to the HFA’s 2025 US Health & Fitness Consumer Report.

The increase both in total visits and monthly visits per visitor also points to a broader trend: Not only are more Americans using fitness facilities, but they are also incorporating regular, facility-based workouts more regularly into their routines.

A Real-Time View Into Industry Momentum

The FIT Tracker is a first-of-its-kind quarterly report tracking foot traffic at nearly 11,000 fitness facilities nationwide, which represents approximately one-fifth of all commercial locations.

Developed by HFA in partnership with Sports Marketing Surveys USA (a Buffalo Groupe company) and powered by Placer.ai, the FIT Tracker analyzes millions of anonymized location data points and categorizes key visitation metrics by four facility types:

- High-volume low-price (HVLP)

- Mid-priced

- Luxury

- Boutique/studio

Budget-Friendly Gyms Lead the Way

The data shows that HVLP and mid-priced gyms were the main drivers of industry growth in the first half of 2025.

- HVLP facilities—including brands like Planet Fitness, Crunch, and EōS Fitness—saw a 3.8% increase in total visits, with an average of 193,000 visits per location, the segment’s strongest start on record.

- Mid-priced gyms followed closely with a 3.7% year-over-year increase in total visits. This category includes national chains and regional operators such as Anytime Fitness, LA Fitness, and Gold’s Gym.

The strong performance of these segments reflects ongoing consumer price sensitivity amid ongoing inflation concerns. It’s clear that Americans see their fitness as a priority, but are increasingly choosing options that deliver both value and results.

Premium Segments Show Mixed Signals

The data shows somewhat mixed results when looking at premium segments, which include luxury facilities and boutiques/studios.

Luxury gym users are showing more commitment and longer visits.

- They maintained the highest overall traffic with over 315,000 visits per location

- They also had the most engaged visitors, with 5.2 monthly visits per person, averaging 86 minutes per visit.

However, despite these leading engagement numbers, luxury facilities did see a modest 0.9% decline in average visits compared to the first half of 2024.

Boutique studios, on the other hand, which include brands such as Orangetheory Fitness and Pure Barre, saw a slight growth of 0.8% in total visits, but visit frequency remained lower at 2.5 times per month per user.

These trends suggest premium segment members remain loyal, but also that these brands may face headwinds for acquisition and growth due to consumers’ broader economic concerns.

Affordability Drives Regional Growth

The report also tracks trends by regions. While there was some variation within regional performance, one segment consistently outperformed the others: budget gyms (HVLPs and mid-price).

Mid-priced gyms led in the Mid-Atlantic region at 12.6% YoY total visit growth. HVLP gyms generally outperformed other categories in the Southern and Midwestern regions. And the Pacific and Mountain regions led growth across multiple facility types.

The consistent growth of HVLP and mid-priced gyms across multiple regions underscores a key industry reality: affordability remains a driving force behind consumer behavior.

For operators, this signals a need to emphasize value and consider strategies that meet consumers where they are. Regionally, the outperformance of HVLP gyms, especially in the Mid-Atlantic and Pacific states, also provides a strategic roadmap for expansion, marketing, and investment.

The data in HFA’s FIT Tracker offers a real-time look at how Americans are prioritizing fitness in 2025, revealing that consumer demand is growing for affordable options and that the American fitness consumer, and the industry at large, has no intent of slowing down.